Without AI, the US economy would not grow this year

Investment in data centers accounts for 98% of US GDP growth, according to a Harvard economist

BarcelonaThe US economy would have barely grown in the first half of 2025 were it not for the investment in data centers made by major artificial intelligence (AI) companies, according to a study by Jason Furman, a professor of economics at Harvard. This data, corroborated by other economists, lends further weight to the argument that the AI industry is affected by a bubble that is causing its companies to become oversized. Specifically, Furman's calculations estimate that although investment in software and equipment represents only 4% of total US gross domestic product (GDP, the indicator that measures the size of an economy), it contributed 92% of all growth recorded in the country between January and June. In other words, without the large investments in AI, the annualized growth rate of US GDP would have been only 0.1%, practically zero.

The Harvard professor, who also served as chairman of the White House Council of Economic Advisers during Barack Obama's presidency, clarified in a message on social media that without this massive investment in the AI sector, growth would likely have been positive, but much lower. The issue, according to Furman, is that the fact that large multinational AI companies are investing so heavily in these centers has two negative effects on the growth of other sectors.

First, the high electricity consumption required increases the cost of electricity for households and businesses in other sectors. Second, interest rates would likely be lower without these investments, as the demand for credit would be lower and the Federal Reserve would be forced to lower interest rates. In any case, both the increased cost of electricity and higher interest rates have a negative effect on consumption and investment by households and businesses, thus depressing economic growth.

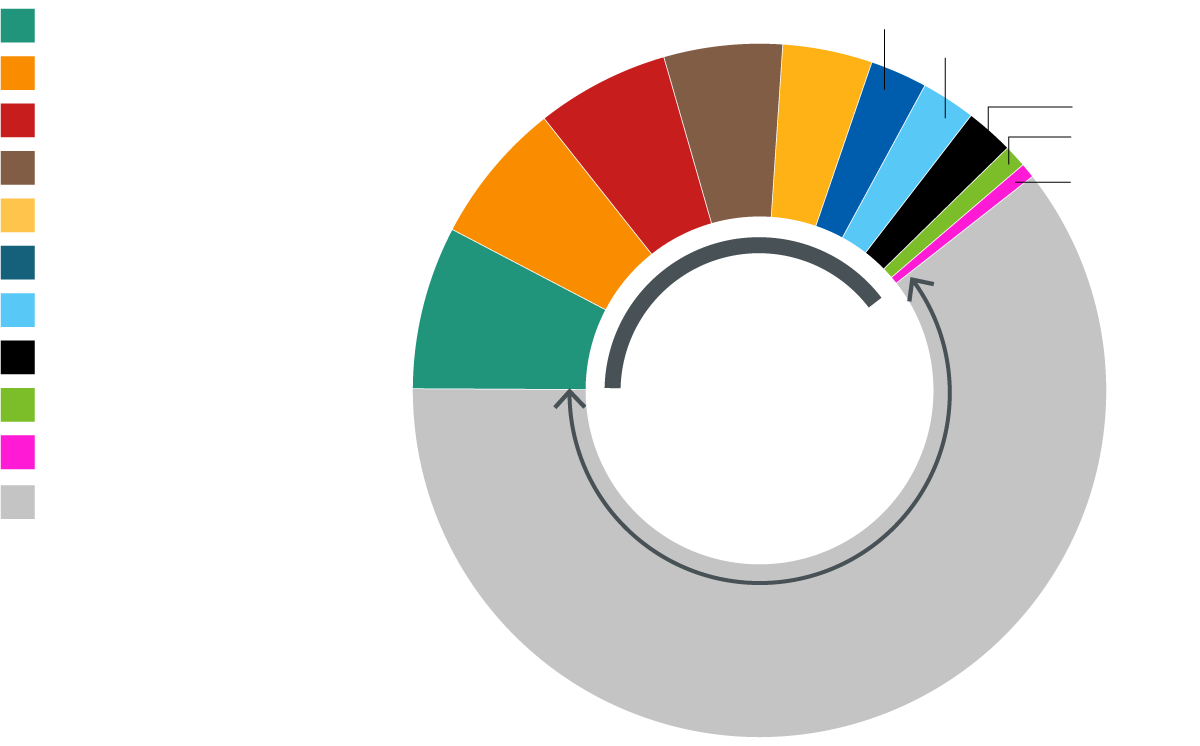

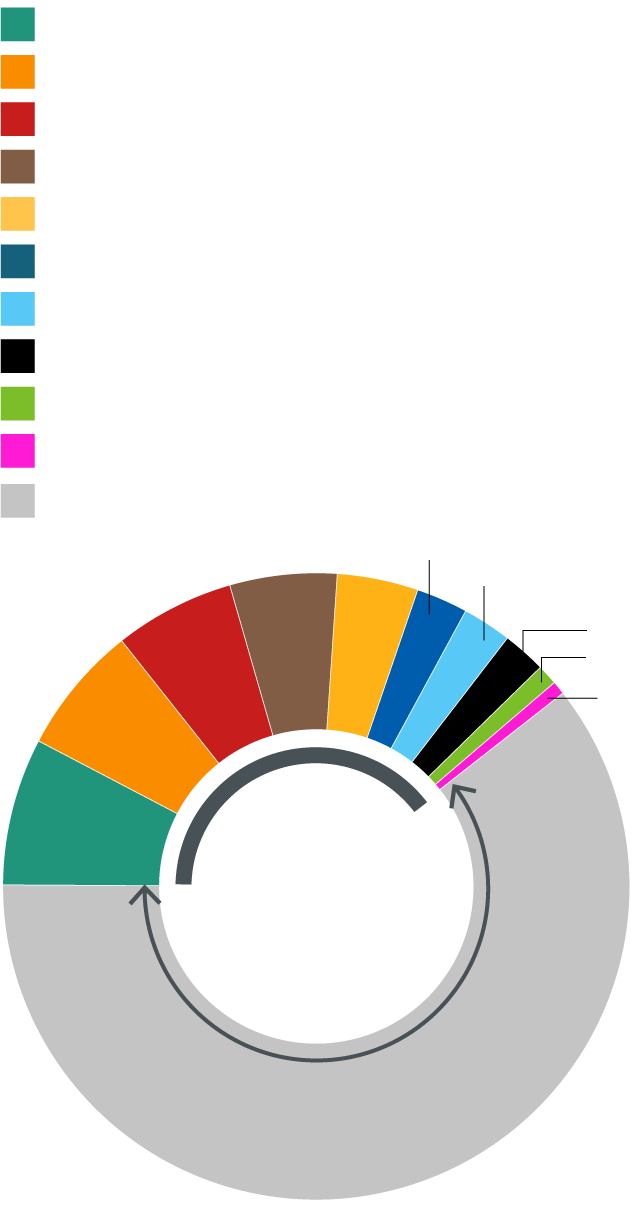

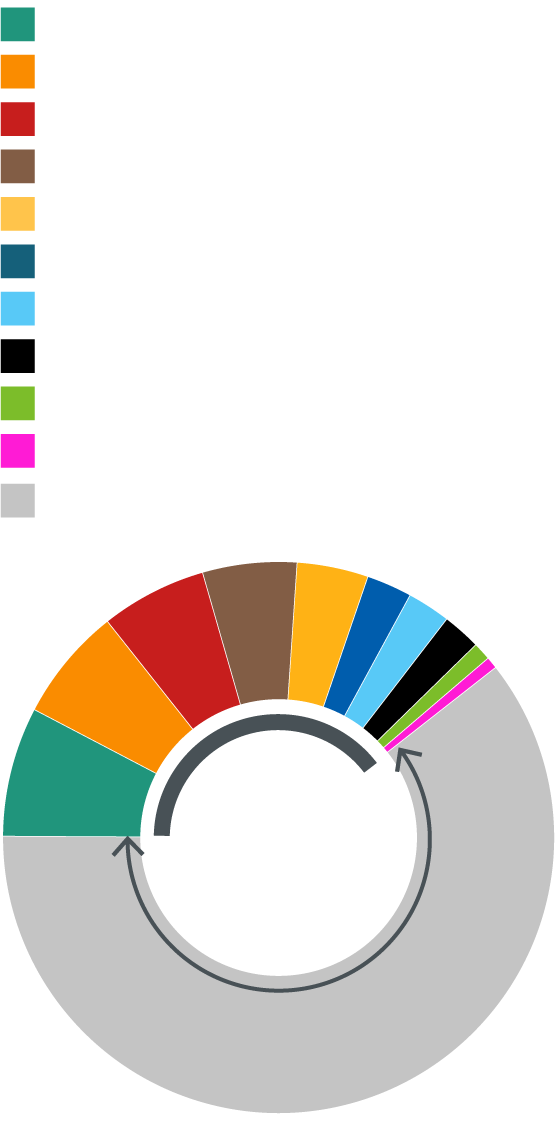

Furman's data is a new sign pointing to a bubble in the AI industry. The fact that the growth of the US economy depends exclusively on investments in data centers may seem excessive, but it becomes clearer when considering the size of the sector's major companies and their stock market valuations. In the S&P 500, the stock market index that includes the 500 largest publicly traded companies in the US, the value of the 10 multinationals that invest the most in AI—Nvidia, Apple, Microsoft, Alphabet (Google), Amazon, Broadcom, and Meta (Facebook, Instagram, etc.)—makes up 60% of the total index value. In other words, the remaining 490 companies account for the missing 60%. This is an indicator that many analysts point to as a sign of a market bubble.

Similarly, there are other factors that also point to an overvaluation of these companies, which will have to be corrected at some point. For example, the Fisher P/E ratio is an indicator frequently used to determine if there are bubbles in the US stock market. The index takes the value of the S&P 500 and divides it by the average earnings of the 500 companies that comprise it. Thus, the higher the resulting figure, the more overvalued the stock market is and, therefore, the greater the likelihood that it will experience a more or less sudden drop to correct its value.

Currently the index is at 39.97, the highest figure since the bursting of the tech bubble. dot comIn 2001 – the peak at that time was 43.83 in 1999 – and above the levels recorded during the 1929 stock market crash, which ushered in the Great Depression, when the peak was 32.56.

Fears of a bubble persist

In recent weeks, investor movements have revealed growing fears of a stock market bubble fueled by the overvaluation of AI. The most obvious example has been that of investment giant Berkshire Hathaway, the company founded by billionaire Warren Buffett, which has sold its positions in two funds linked to the S&P 500. Conversely, it has increased its investment in the Domino's pizza chain (fast food consumption increases in the US during crises).

Last week the Financial Times Deutsche Bank reported that it was exploring options to cover potential losses stemming from its exposure to AI companies and the well-known investor Michael Burry Burry posted some short positions (i.e., bets that a company will lose value) on X against Nvidia and Palantir, two of the giants of artificial intelligence. However, this week Burry clarified his position: contrary to what the US press reported, the investor explained that he doesn't have more than $900 million invested against Palantir, but only $9 million, a very significant difference that casts doubt on whether he is entirely convinced of the existence of a bubble in the AI sector.

However, Burry dispelled the doubts by changing his X profile picture, which went from a still from the movie Star Wars in a painting by the 17th-century Dutch painter Jan Brueghel entitled Allegory of Tulip Mania, which deals with the first financial bubble in modern history, which took place with speculation on tulip bulbs in the Netherlands.